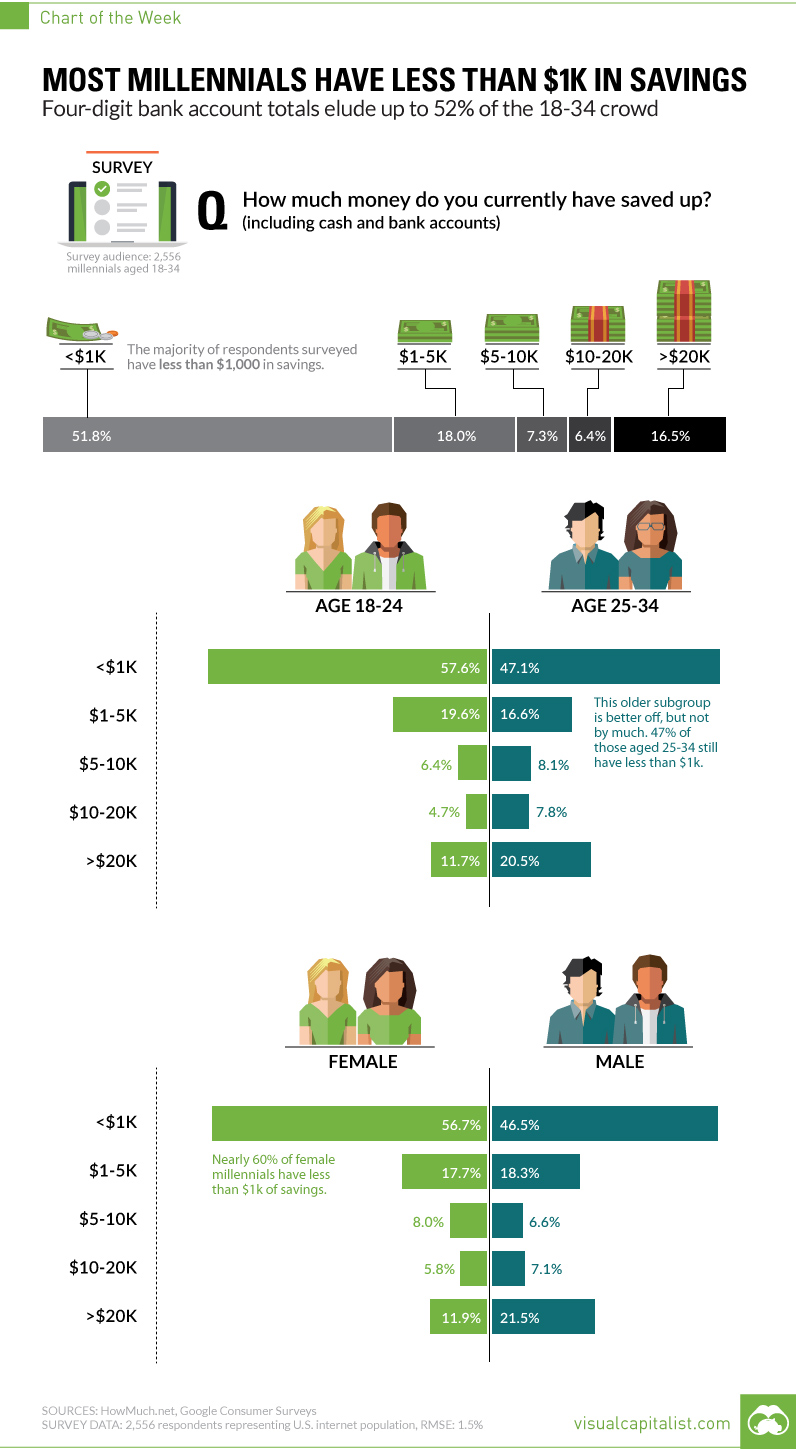

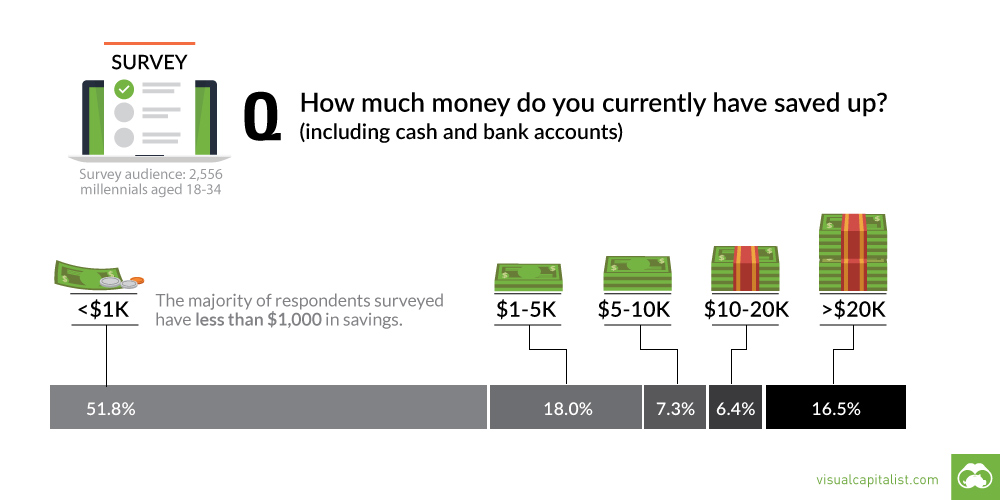

Chart: Most Millennials Have Less Than $1,000 in Savings

Four-digit bank account totals elude 52% of the 18-34 crowd

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. The majority of millennials are living paycheck to paycheck. A recent survey of millennials by HowMuch.net found that 51.8% of those aged 18-34 have less than $1,000 held between bank accounts and cash savings. This echoes previous data we’ve seen – not just on millennials, but Americans in general. For example, we know that 14% of Americans have “negative” wealth. We also know that 62% of Americans don’t have emergency savings that could cover a $1,000 hospital visit or a $500 car repair. Taking that into consideration, let’s dive deeper into this more recent millennial data.

Younger vs. Older Millennials

The broad survey data can be further divided into “younger” and “older” millennial segments: those aged 18-24, vs. those between 25-34. Based on the survey question, an intuitive expectation would be that younger millennials are much more likely to have less than $1,000 in savings. After all, many of the people in this group would still be in school, and many are struggling with student debt. However, the difference is far less than one may expect. While it is true that 57.6% of the younger demographic has less than $1,000 in savings, the older group is not much better off with almost half (47.1%) of them being in the same boat. This shows that many millennials in their late 20s and early 30s are still not able to generate substantial savings.

Male vs. Female Millennials

There is also a significant divide between male and female millennials here, with 56.7% of females having less than $1,000 in savings. Compare this number to the male percentage of 46.5%, and it is clear there is a substantial divide between genders. Lastly, males are also more likely to have a substantial amount stored away in their bank account. According to the survey, 21.5% of males have more than $20,000 of savings, while only 11.9% females can say the same. on To see how the minimum wage differs around the world, we’ve visualized data from Picodi, which includes values for 67 countries as of January 2023.

Monthly Minimum Wage, by Country

The following table includes all of the data used in this infographic. Each value represents the monthly minimum wage a full-time worker would receive in each country. Picodi states that these figures are net of taxes and have been converted to USD. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet. In fact, a 2022 survey found that 70% of people in Turkey were struggling to pay for food. Argentina, South America’s second-biggest economy, is also suffering from very high inflation. In response, the country announced three minimum wage increases throughout 2022.

Minimum Wage in the U.S.

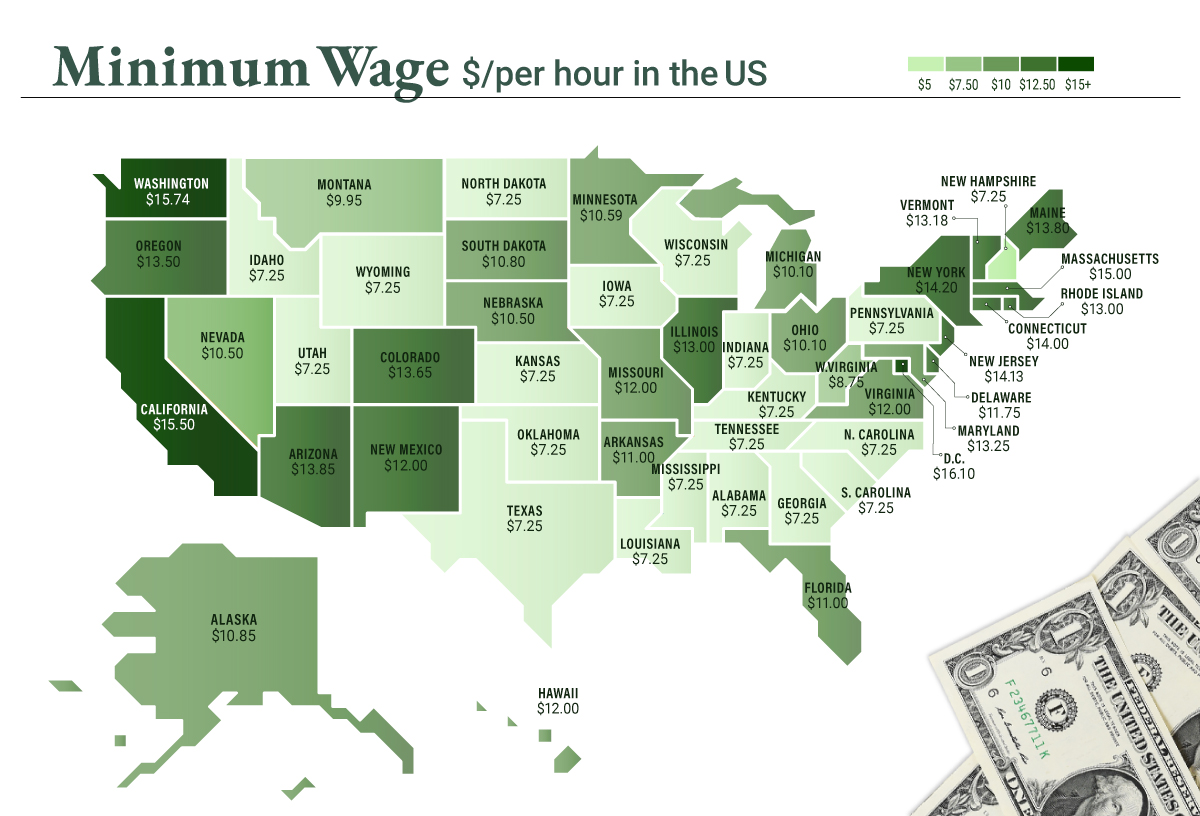

Within the U.S., minimum wage varies significantly by state. We’ve visualized each state’s basic minimum rate (hourly) using January 2023 data from the U.S. Department of Labor.

2023-03-17 Update: This map was updated to fix several incorrect values. We apologize for any confusion this may have caused. America’s federal minimum wage has remained unchanged since 2009 at $7.25 per hour. Each state is allowed to set their own minimum wage, as long as it’s higher than the federal minimum. In states that do not set their own minimum, the federal minimum applies. If we assume someone works 40 hours a week, the federal minimum wage of $7.25 translates to an annual figure of just $15,080 before taxes. California’s minimum wage of $15.50 translates to $32,240 before taxes. For further perspective, check out our 2022 infographic on the salary needed to buy a home across 50 U.S. cities.