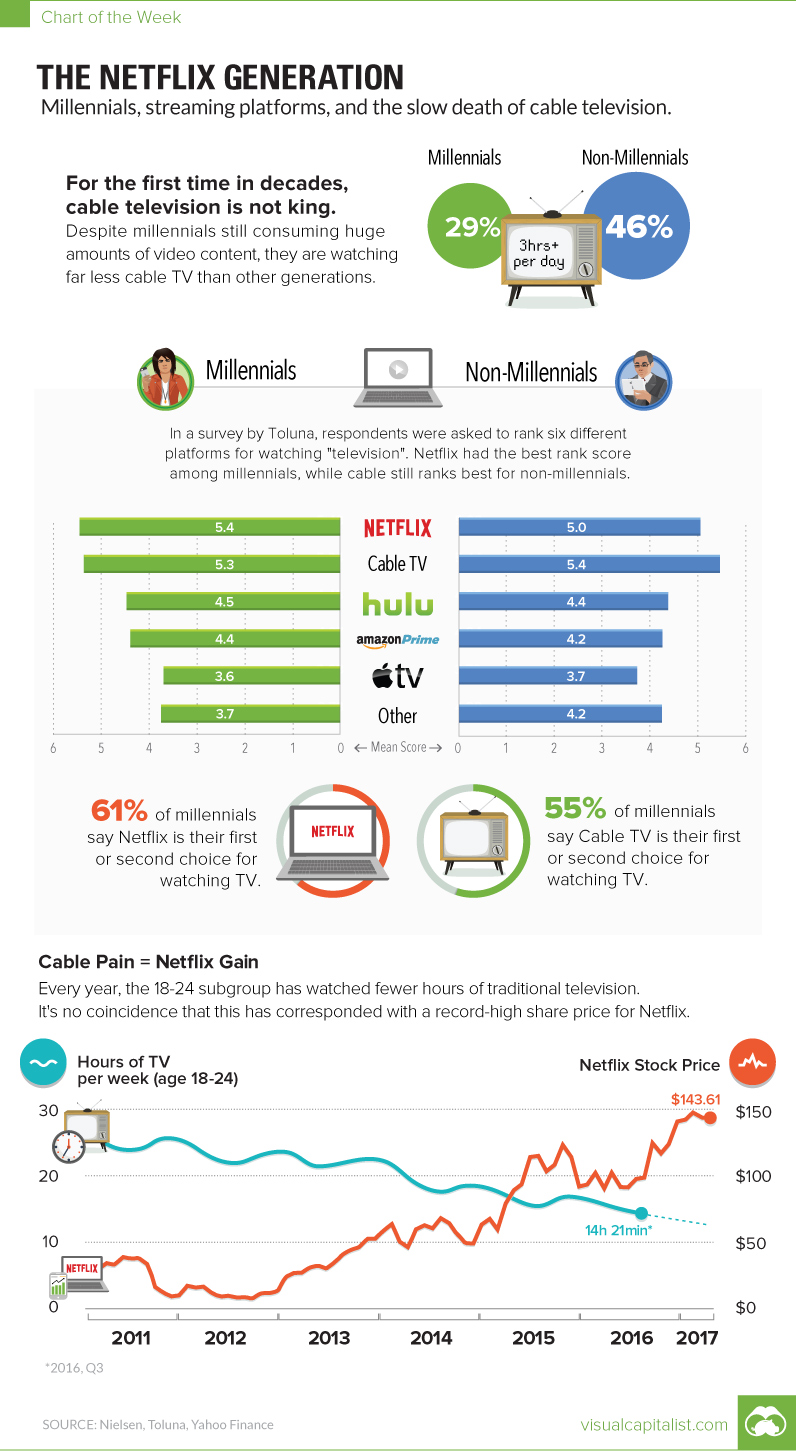

Chart: The Netflix Generation

Millennials, streaming platforms, and the slow death of cable television

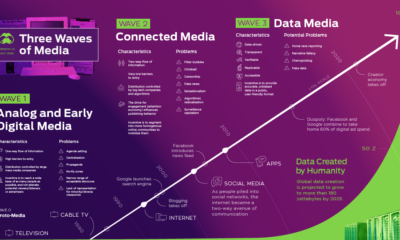

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. Since launching in the United States in 1948, cable television quickly emerged as the media consumption method of choice for families around the world. Cable brought to us some of the most memorable and noteworthy events in history. People saw the fall of the Berlin Wall from their living rooms in 1989 – and many even remember being inspired by Neil Armstrong taking his first steps on the moon twenty years earlier. And although television is still a vital medium today, it is also stuck in an inevitable quagmire. Digital already generates more ad revenue than television, while more people switch to streaming platforms every day. Make no mistake – even though there is still plenty of money to be made in television, cable is experiencing a slow death, just like other traditional media channels. It might not yet be reduced to the more niche territory of radio or print, but cable is treading the same path.

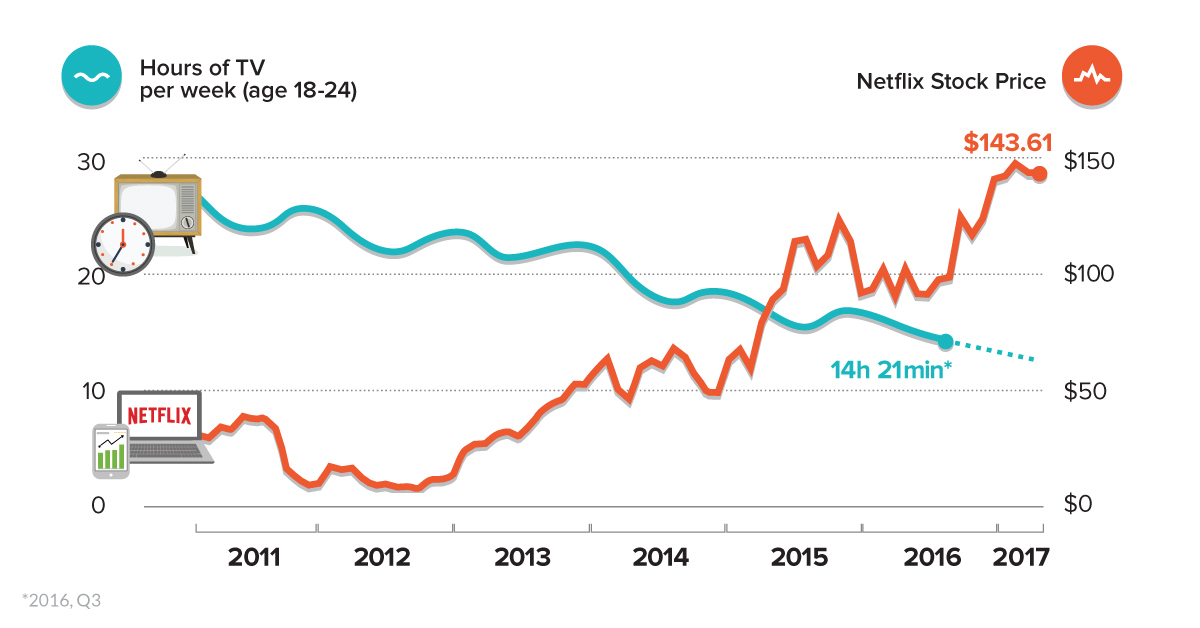

The Digital Natives

Why this is the case is very simple math. Even just six years ago in 2011, the average 18-24 year old millennial consumed about 25 hours of traditional television per week – today, they consume closer to 14 hours. That said, it’s no surprise that the first generation of digital natives skews heavily towards digital content, but what will be even more interesting is the behavior of the next generation on deck: Gen Z (born in 2000 and onwards). This cohort was born into a world of screens and iPhones, and will not be aware of a prior era. To them, flipping through channels on cable television seems even more antiquated and arbitrary than it does to older generations. – Shireen Jiwan, chief brand experience officer at Lucky Brand Less than an hour per day is not very conducive to the cable business, especially when there are hundreds of channels in existence today. And while insights on Gen Z are still fluid and evolving, it’s highly doubtful that the generation will do a 360 on video anytime soon. In the meantime, cable’s survival as a dominant medium rests squarely on the shoulders of older generations. While it works as a business for now, cable can’t fight the demographics forever. on Similar to the the precedent set by the music industry, many news outlets have also been figuring out how to transition into a paid digital monetization model. Over the past decade or so, The New York Times (NY Times)—one of the world’s most iconic and widely read news organizations—has been transforming its revenue model to fit this trend. This chart from creator Trendline uses annual reports from the The New York Times Company to visualize how this seemingly simple transition helped the organization adapt to the digital era.

The New York Times’ Revenue Transition

The NY Times has always been one of the world’s most-widely circulated papers. Before the launch of its digital subscription model, it earned half its revenue from print and online advertisements. The rest of its income came in through circulation and other avenues including licensing, referrals, commercial printing, events, and so on. But after annual revenues dropped by more than $500 million from 2006 to 2010, something had to change. In 2011, the NY Times launched its new digital subscription model and put some of its online articles behind a paywall. It bet that consumers would be willing to pay for quality content. And while it faced a rocky start, with revenue through print circulation and advertising slowly dwindling and some consumers frustrated that once-available content was now paywalled, its income through digital subscriptions began to climb. After digital subscription revenues first launched in 2011, they totaled to $47 million of revenue in their first year. By 2022 they had climbed to $979 million and accounted for 42% of total revenue.

Why Are Readers Paying for News?

More than half of U.S. adults subscribe to the news in some format. That (perhaps surprisingly) includes around four out of 10 adults under the age of 35. One of the main reasons cited for this was the consistency of publications in covering a variety of news topics. And given the NY Times’ popularity, it’s no surprise that it recently ranked as the most popular news subscription.